Hemp flower bans are emerging in a number of states, including many of the new hemp farming states coming online like Georgia, Texas and Louisiana.

Now, Iowa has joined the ranks of states that have banned smokable hemp for the same reason as other state governments: It is perceived as essentially legalizing marijuana.

Georgia law enforcement made news in the fall when they stopped citing citizens for small amounts of smokable cannabis.

Texas prosecutors, and other jurisdictions across the country, issued guidance in 2019, noting that because hemp flower looks and smells identically to marijuana, law enforcement no longer has probable cause when they encounter any type cannabis flower use.

Law enforcement lacks universal access to testing kits that can distinguish low THC-hemp from high THC-marijuana. Current kits only detect the presence of THC, so most hemp flower will appear to be marijuana.

Some states are using European test kits, but these aren’t widely available yet, and this technological limitation is a threat to fledgling hemp markets.

When lawmakers advanced legislation to legalize hemp production nationwide, they envisioned rope and clothes. Lawmakers continue to occasionally crack jokes that nobody would want to smoke hemp, but the reality is far different.

Demand for hemp flower is extraordinary. Hemp is defined in the 2018 Farm Bill as having less than 0.3% THC.

Short, squat and highly resinous plants are high in CBD and other cannabinoids, and barely resemble fiber and grain hemp that are grown in solid stands at high populations, with pencil-thick stems. High-CBD hemp is sometimes compared to Christmas trees, often grown with similar plant spacing and at times, the trunks can reach several inches or more in diameter.

Despite the bans and ongoing legal action in states like Indiana, where a previously overturned ban on the product was recently upheld by a panel of three judges, demand is growing.

Hemp has become a battleground for state’s rights but banning a key revenue driver from the United State’s newest commodity crop is controversial. The economic downturn and already depressed commodities makes financial solvency a pivotal issue in farm country.

Hemp flower can return tens of thousands of dollars per acre in current wholesale markets, simply by high grading the best flowers from a CBD crop destined for CBD extraction.

One of our clients will turn out hundreds of thou-sands of pounds of hemp flower over the balance of 2020, but overall volume in the marketplace is unclear.

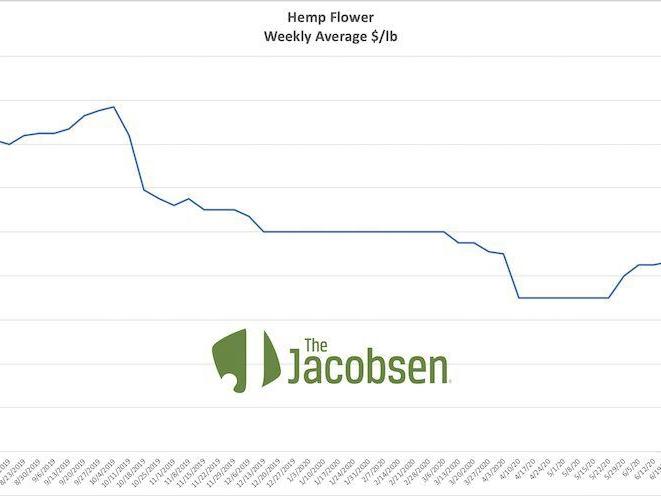

The Jacobsen excels at forecasting in mature agricultural commodities, but hemp lacks sufficient data to confidently provide accurate forecasts for these emerging markets. Nonetheless, our June outlook for hemp flower showed prices strengthening as the segment starts to establish a seasonal cycle, with prices increasing through midsummer before the 2020 harvest.

Western states like Colorado, Oregon and California are advantaged climate-wise when producing high-CBD cultivars destined for premium markets, avoiding mold and ensuing pest and disease issues that impact the dense flowers in humid clients.

More East Coast operators are moving indoors or utilizing greenhouses where they’re able to employ light deprivation to induce flowering and maintain an optimal growth environment. This allows producers in Pennsylvania and New York, and elsewhere in the Eastern U.S., to harvest several “turns” each year.

The Link LonkJuly 27, 2020 at 07:26PM

https://www.lancasterfarming.com/market_news/hemp-flower-demand-and-bans-both-on-rise/article_6650a740-d004-11ea-adf7-db5b6aa5ee51.html

Hemp Flower Demand, and Bans, Both on Rise - Lancaster Farming

https://news.google.com/search?q=Flower&hl=en-US&gl=US&ceid=US:en

No comments:

Post a Comment